Scandinavia's Socialist-Market Economy

-

A Big Safety Net and Strong Job Market Can Coexist ― Just Ask Scandinavia

by Neil Irwin of _The New York Times

December 17th, 2014It is a simple idea supported by both economic theory and most people’s intuition: If welfare benefits are generous and taxes high, fewer people will work. Why bother being industrious, after all, if you can get a check from the government for sitting around — and if your choice to work means that much of your income will end up in the tax collectors’ coffers?

Here’s the rub, though: The idea may be backward.

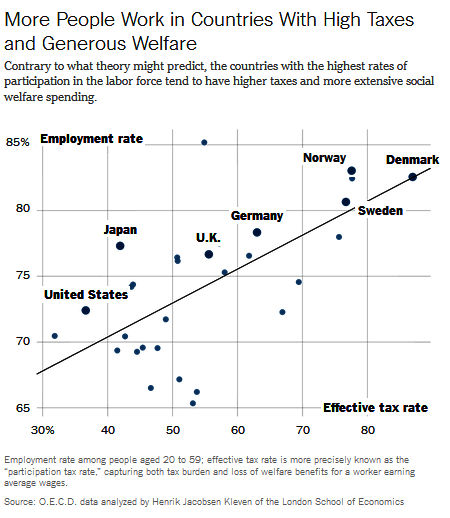

Some of the highest employment rates in the advanced world are in places with the highest taxes and most generous welfare systems, namely Scandinavian countries. The United States and many other nations with relatively low taxes and a smaller social safety net actually have substantially lower rates of employment.

In Denmark, someone who enters the labor force at an average salary loses 86 percent of earnings to a combination of taxes and lost eligibility for welfare benefits; that number is only 37 percent in the United States. Yet the percentage of Danes between the ages of 20 and 59 with a job is 10 percentage points higher than in the United States.

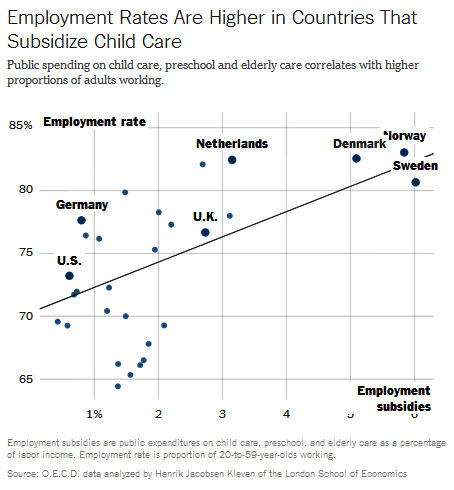

In short, more people may work when countries offer public services that directly make working easier, such as subsidized care for children and the old; generous sick leave policies; and cheap and accessible transportation. If the goal is to get more people working, what’s important about a social welfare plan may be more about what the money is spent on than how much is spent.

That is the argument that Henrik Jacobsen Kleven, a professor at the London School of Economics, offers to explain the exceptional rates of participation in the work force among citizens of Sweden, Norway and his native Denmark.

If correct, it could have broad implications for how the United States might better use its social safety net to encourage Americans to work. In particular, it could mean that more direct aid to the working poor could help coax Americans into the labor force more effectively than the tax credits that have been a mainstay for compromise between Republicans and Democrats for the last generation.

In Scandinavian countries, working parents have the option of heavily subsidized child care. Leave policies make it easy for parents to take off work to care for a sick child. Heavily subsidized public transportation may make it easier for a person in a low-wage job to get to and from work. And free or inexpensive education may make it easier to get the training to move from the unemployment rolls to a job.

In the United States, the major policies aimed at helping the working poor are devised around tax subsidies that put more cash in people’s pockets so long as they work, most notably through the Earned-income tax credit and Child Tax Credit.

“The United States doesn’t do much of anything in terms of supporting labor force participation via expenditures,” Mr. Kleven said.

There is a solid correlation, by Mr. Kleven’s calculations, between what countries spend on employment subsidies — like child care, preschool and care for older adults — and what percentage of their working-age population is in the labor force.

Consider Marianne Hillestad of Steinberg, Norway. She teaches kindergarten; her husband, Ruben Sanchez, installs heating and ventilation systems. Day care for their three children, ages 4, 7, and 9, works out to about $1,100 a month; Ms. Hillestad estimates that if she had to pay a market rate, it would be nearly twice that, eating up most of her paycheck.

“Using day care and working full time was a matter of costs and benefits,” Ms. Hillestad said. “The system is designed to keep us working. Maybe there are loopholes, but I could not sleep well at night if I was trying to cheat the system just to cash in social benefit checks.”

Collectively, these policies and subsidies create flexibility such that a person on the fence between taking a job versus staying at home to care for children or parents may be more likely to take a job.

“Being home with my children is a blessing," said Camilla Grimsland Os, a nurse in Oslo. “But I like my work, I like my colleagues, and I feel that I contribute when I go to work.”

It is probably overly simplistic to attribute the very high employment rates in Scandinavia to a handful of policies that encourage work, as Mr. Kleven himself concedes; he is “more trying to raise a puzzle” than to provide a definitive answer. There are countless differences between Northern European countries and the rest of the world beyond child care policies and the like. The Scandinavian countries may have cultures that encourage more people to work, especially women.

And this analysis may leave out some other factors that lead more Northern Europeans to join the work force than Americans.

Robert Greenstein, the president of the Center on Budget and Policy Priorities, notes that wages for entry-level work are much higher in the Nordic countries than in the United States, reflecting a higher minimum wage, stronger labor unions and cultural norms that lead to higher pay. (In October, my colleagues Liz Alderman and Steven Greenhouse wrote about $20-an-hour Burger King employees in Denmark.)

Perhaps more Americans would enter the labor force if even basic jobs paid that well, regardless of whether the United States provided better child care and other services. The employment subsidies Mr. Kleven cites surely help coax more Scandinavians into the work force, Mr. Greenstein agrees, but shouldn’t be viewed in isolation.

“You get into trouble when you cherry-pick things,” Mr. Greenstein said.

But even conservatives can see some useful lessons in the Scandinavian system.

“I’ve advocated expanding transportation options for low-income workers in order to help them get to work, and I think everybody agrees that we could do better with education,” said Michael Strain, a resident scholar at the American Enterprise Institute. “I think the Scandinavian countries do those things well, and there are certainly things we can learn.”

But that outlook changes, he argues, when looking at subsidized child care. In effect, the United States’ system of tax credits for the working poor allows people to make their own choices over how to use the money, whether for child care, food or clothing.

“I’m more in favor of the child tax credit,” Mr. Strain said. “You can spend the child tax credit on child care if you want to, or spend it on whatever else you need. Do we effectively want government subsidizing the child care industry for middle-class parents?”

If the United States were to subsidize child care, that benefit would join tax subsidies of employer-provided health insurance, home mortgages and retirement savings as policies that tend to favor the middle and upper-middle class.

Every country has a mix of taxes, welfare benefits and policies to promote work that reflects its politics and culture. In the large, diverse United States, there is deep skepticism of social welfare programs and direct government spending, along with a greater commitment to keeping taxes low.

So for reasons intertwined with politics and history, the United States has relied on a different set of policies aimed at helping workers get a leg up. But as policy makers around the world try to encourage growth by increasing the proportion of their populations with a job, there is a lesson from Scandinavia useful in its simplicity: If you make it easier for people to work, it may be the case that more will._